Last Updated on August 25, 2023

How Long Do Closed Student Loans Stay On Credit Report?

Credit scores are used to help determine whether a borrower is likely to repay a loan. The more you owe, the worse your credit score will be. With student loans, however, it can be difficult to know how long they will stay on your credit report after you’ve paid them off.

There are several factors that influence how long student loans remain on your credit report:

When you first take out a loan and when you pay it off

How much money you owe each month and how often you make payments

The type of loan (whether it’s federal or private) and whether or not it’s subsidized by an employer or government agency

How Long Do Closed Student Loans Stay On Credit Report

Paying off debt removes a bill from your budget, but that paid-off loan or closed credit card can stay on your credit report for years.

That’s great news if you paid on time: That positive payment information can continue to help your credit score.

But if you didn’t, your credit missteps can linger.

Why do closed accounts stay on your credit report?

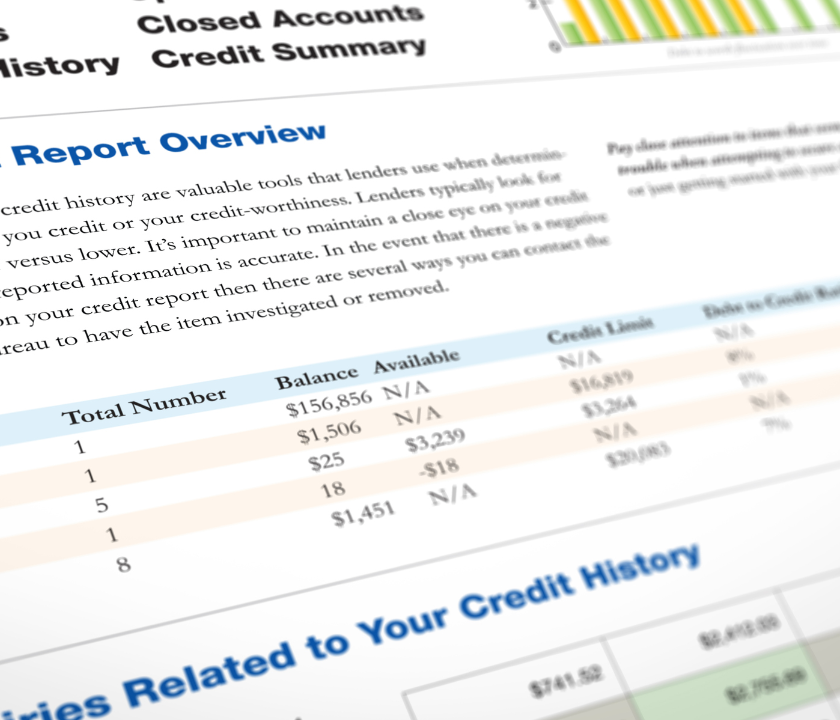

A credit report is a detailed document listing information about how you’ve handled borrowed money. You have a credit report from each of the three major credit bureaus — Equifax, Experian and TransUnion — which get data about your accounts from lenders and compile it. That data is then used to calculate your credit scores.

Your reports list both positive and negative information about how you manage credit. For instance, if you always pay your car loan on time, it will be listed as in good standing. On the other hand, if you’ve paid late, that will be noted.

Including both open and closed accounts gives more data about your use of credit, which helps credit scores more accurately portray what type of customer you are.

It’s a common misconception that your credit report includes only information about your active accounts. Unless you have a very limited credit history, your credit report is probably full of data about closed accounts, like loans and credit cards you paid off years ago.

How long do closed accounts stay on your credit report?

How long a closed account will stay on your credit report depends on how you handled the payments.

Accounts in good standing — that is, you paid as agreed month after month — can remain on your credit report for up to 10 years. That’s good news. Payment history is the most influential of the factors that af fect your credit scores.

If you defaulted or had late payments on an account, it must come off your credit report after 7½ years from the date the account was first reported delinquent, according to federal law. Most other negative information comes off after seven years. The only derogatory mark that can stick around longer is a Chapter 7 bankruptcy, which will remain on your credit report for up to 10 years.

how to remove student loans from credit report

If you’re wondering how to remove federal student loans from your credit report when they’re in default, you may be able to get the notation removed by rehabilitating the loan.

This process requires you to make nine reduced monthly payments over a 10-month period. Once you complete those payments, the default is removed from your credit report.

You’ll need to contact your loan servicer to begin this process. You’ll submit information about your income, which the servicer will use to calculate your reduced monthly payment.

Another way to get out of default is to consolidate your loan and meet certain payment requirements. However, this won’t result in having the default status removed from the original loan.

Private Student Loans

If your private student loans are in default legitimately, there’s generally no way to get that negative item removed from your credit reports.

Private lenders don’t offer rehabilitation, and while you can technically refinance the loans with a different lender, you may have a hard time qualifying with a defaulted account on your credit report.

How Long Will Student Loans Stay on a Credit Report?

If you have a late payment on a student loan — or any credit account for that matter — it’ll remain on your credit reports for seven years. If the loan goes into default, though, that clock doesn’t reset, so it will stay on your reports for seven years from the date of your first missed payment.

As a result, it’s crucial that you make your payments on time because missing payments can damage your credit for years and make it challenging to get approved for financing in the future.

How to Dispute Student Loans on Your Credit Report

You’ll have a hard time removing student loans from your credit report if the negative information is legitimate. But there may be instances when the details are inaccurate. In these cases, you can dispute the information with your creditor or the credit reporting agencies.

If you want to start with your loan servicer or lender, here’s how to dispute delinquent student loans or loans in default:

Write a dispute letter: It’s best to complete this process in writing, so you have a paper trail you can refer back to in the future if needed. Write a letter to your servicer notifying them of the inaccuracy and requesting that they remove it from your credit reports.

Gather supporting documentation: Before you send your letter, gather some documentation to support your claim. This can include bank statements or emails from the servicer showing you made on-time payments or any other reason why you believe the delinquency or default notation was made in error.

Wait for a decision: Once you submit your letter, it may take a couple of weeks to get a response. If you don’t hear back in two or three weeks, contact the servicer to follow up on your letter.

If you’re having a hard time dealing with your loan servicer or you’d simply rather not deal with them, you can also file a dispute directly with the credit reporting agencies. You can typically do this online, but still, make sure you provide supporting documentation for your claim.

The credit bureaus can take up to 30 days to investigate your dispute and will contact your creditor to handle this process on your behalf. If they rule in your favor, the negative item will be removed.

Here are some situations where you can file a dispute with the student loans on your credit report.