Last Updated on July 29, 2023

What’s the best way to pay off student loans?

That’s a question that’s on the minds of many who are struggling with debt. And it’s a question that comes up often in the Reddit community, with users offering their own advice on how other people can get out from under their loans faster.

In this post, we’ll take a look at some of the most popular suggestions and provide our own take on each one.

How To Pay Off Student Loans Faster Reddit

Pay Off Your Student Loans Smarter (and Faster)

Ever feel like you’ll be paying back your student loans for the rest of your life? You’re not alone. Student loan debt can feel crushing at times, but there are many manageable ways to chip away at it. With these tips, you can work toward paying off your student loans smarter and faster.

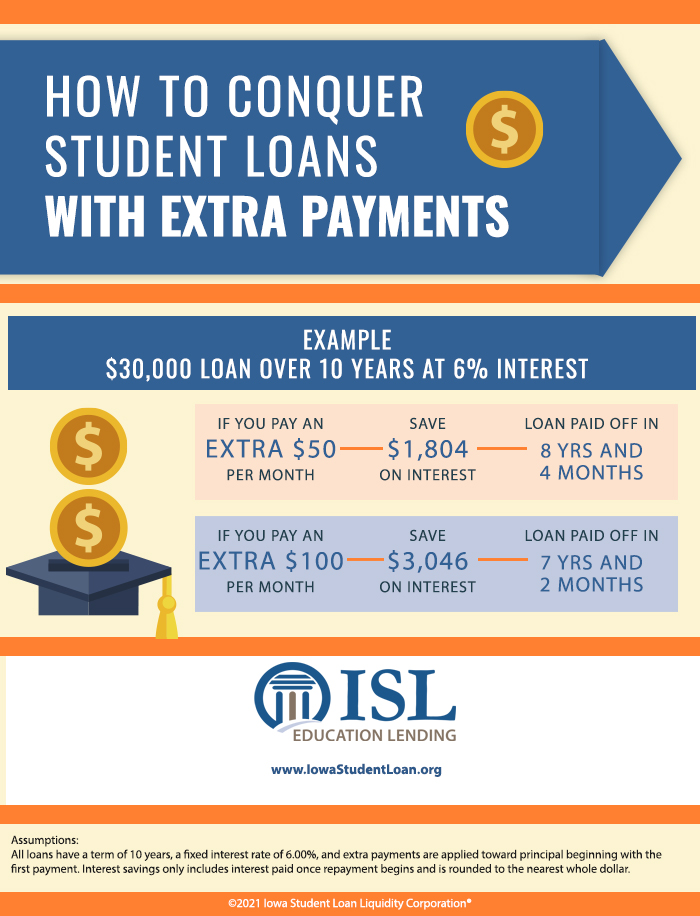

Pay More than Your Minimum Student Loan Payment

One of the most effective ways to pay your student loans off quicker is to pay extra toward those loans each month. Paying the minimum required amount might be enough to keep you in good standing but that means it will still take you the entire repayment term to get out of debt.

Adding a little extra money each month toward your loans can make a big difference, and if you have the income to do this, you’ll save money on interest and time in repayment.

How to conquer student loans with extra payments. Example loan of $30,000 over 10 years at 6 percent interest. If you pay an extra $50 per month, you save $1,804 on interest, and the loan is paid off in 8 years and 4 months. If you pay an extra $100 per month, you save $3,046 on interest, and the loan is paid off in 7 years and 2 months.

Make Additional Student Loan Payments Throughout the Year

If putting extra money toward your student loans each month isn’t possible, try making a few extra payments throughout the year. This is a great place to start if you’re still trying to figure out just how much you have left over in your budget each month. Set a goal to make an extra payment once every three or six months and see how that impacts your student loan debt.

Don’t Blow Raises and Bonuses

A bonus or raise at work can be thrilling, and it may be tempting to spend that extra money on some “splurge” items. If you receive an unexpected bonus or raise, though, and are not relying on the money for a specific need, you can spend it on your student loans. Doing this can really help to reduce your debt more and, if you put just the bonus or extra take-home amount toward your loans, it won’t even impact your budget.

Make Some Extra Money to Put Toward Student Loans

If you feel like you don’t have enough income to contribute extra to your student loan payments, consider a part-time job to help with your budget. The best kind of part-time job is one where you get to do something you enjoy. For some people that means taking up tutoring, babysitting or music lessons. Find something that works well with your lifestyle and schedule.

Just remember to make a plan to manage that extra income. Come up with a schedule for saving money or putting it directly toward the balance of a loan as you reach a certain amount. It can be very easy to spend money that is designated for loans if it’s just sitting around, so make sure you develop a good system for accountability.

Creative Ways to Make Extra Money

If you don’t want to commit to a part-time job, there are more creative ways to make money. You may be able to find freelancing work that fits with your skills; try searching the internet for freelancing gigs. Selling items online or at a consignment shop can help you reduce your belongings while increasing your bank account. These are just a few unique ways to make extra money to pay down your student loan debt faster.

See if Loan Forgiveness Is an Option

Loan forgiveness is not necessarily too good to be true. Not all people are eligible for this benefit, but if you are eligible, loan forgiveness can save you thousands of dollars.

The federal government offers several loan forgiveness programs depending on your career and types of debt. However, there are lots of scams online about student loan forgiveness, so be sure to use a reputable source, like the Federal Student Aid website.

Many states also offer loan forgiveness programs for teachers, nurses and workers in other high-demand but lower paying fields. Be sure to check out what the state you live in offers as far as loan forgiveness programs. Another source is the financial aid office at the college or university you attended as those experts can help you find loan forgiveness or grant programs.

Budget to Save Money in Other Areas

Not sure how people manage to have leftover money after bills, loans and fun? You should try budgeting! Budgeting is great because it establishes boundaries for your spending and helps you keep track of where your money is going. This monthly budget calculator can help you get started. When you’re not tracking your spending, you might not even realize just how much you’re spending on certain things.

Once you’re actively managing your spending, you’re more accountable and you’ll likely find you have more money to spend — money that you can put toward paying off loans, saving or investing.

Find Out if Refinancing Can Help You

Refinancing is an option anyone with student loan debt should look into as it’s one of the most effective ways to save money and pay off loans quicker without breaking the budget.

Refinancing your student loans is most worthwhile when you can lower the interest rate you’re paying or combine your loans into a single loan with a shorter term. Both of these cases can help you pay less in interest over the life of the loan.

ISL Education Lending provides a simple and quick way to find out the rate you would qualify for with our refinance loan and it doesn’t impact your credit score. See if you qualify today.

If you have someone with good credit who is willing to cosign a new loan, you may qualify for an even better rate, saving you even more in interest charges.

Not ready to pre-qualify? Use our student loan refinance calculator to compare your current monthly payment amounts to the estimated amounts you could pay with our refinance loan.

Interested in learning more about our refinancing? Check out our beginner’s guide for refinancing.

Get Your Rate

Tips to Chip Away at Debt

Get creative! With a little bit of effort, your student loans will be gone before you know it.

Remember these tips to work toward paying off your student loans faster:

- Pay more than the required minimum monthly payment amount.

- Make additional student loan payments when you can.

- Put any extra earnings or bonuses toward student loans.

- Look at ways to increase your income or decrease your spending.

- Consider refinancing your existing student loans.

how i paid off my student loans

How I paid off $90K in student loans in 1 year

Key takeaways

- If you’re paying down student loans, make sure you fully understand what you owe, including your total balances, interest rates, and loan types.

- Following a budget may help you free up cash for loan payments.

- Make sure that any extra payments you make are applied directly to your loan’s principal.

- Consider whether consolidating, refinancing, or switching repayment plans (for federal loans) is a good fit for your situation.

In the summer after graduating from college, Trevor Oldham had a wakeup call.

“I wanted to see how much I had in loans,” says Oldham, 24, who graduated from the University of Massachusetts Dartmouth in May 2019, with a degree in Management Information Systems. Because his total debt was spread across almost a dozen individual loans, he’d had only a tentative sense of his full balance up until then.

“I figured it was maybe $50,000 or $60,000,” he says, because that was about how much debt his older brother, who’d attended the same university, had graduated with.

The actual tab? Some $89,500.

“I started freaking out,” he says. “I didn’t want to be paying my loans until I was in my 30s.”

Oldham had tried to avoid saddling himself with an impossible debt load in the first place. He’d chosen a state school to help save money and worked on the side during his college years—even while taking as many as 6 classes a semester to make sure he graduated on schedule.

Getting motivated

Oldham has a passion for podcasts. He produced his own podcast during his first 2 years of college, interviewing entrepreneurs about their businesses. Then, in his junior and senior years, he started bringing in extra cash on the side as a freelance podcast editor and booking agent—charging clients a $50 fee in exchange for securing a guest appearance on a show.

Although he usually listened to shows about business and entrepreneurs, in the summer after graduating he started branching out into personal finance podcasts. Those shows gave him the motivation to better understand exactly how much he owed and to start getting serious about his loans.

Getting organized

Oldham found it difficult to get a handle on his student debt with it spread across so many individual loans, much less come up with a payment strategy. So his first move was to consolidate into a single loan.

Consolidating can make it easier to understand what you owe and the terms of your debt, including your loan types, total balance, interest rates, and loan terms. In Oldham’s case, after consolidating he was left with a single $1,500 monthly bill and a 7-year payment schedule.

But consolidation isn’t the only option to consider if you’re looking to restructure your debt or modify payment terms. Federal student loans come with a number of repayment plans borrowers can choose from, including income-based repayment plans, in which the size of your payment may rise or fall with your earnings, and graduated repayment, in which payments start small and increase automatically over time. In some cases, it may also be possible to save on interest by refinancing into a new loan with a lower interest rate.

Spending diet

One of Oldham’s next moves was to start following a budget. “Detailing all my expenses helped me realize I had extra money every month,” he says. After a few months of paying the $1,500 minimum, he found he was able to start bumping his payments up.

Fidelity recommends the 50/15/5 budget, which limits essential expenses to 50% of your income and keeps 30% free for you to use as you see fit (such as for making extra loan payments).

Oldham also found online loan calculators helpful—letting him model how boosting his monthly payments could shorten his repayment period, which gave him motivation to continue increasing his payments. (Take a deeper dive into your own loan numbers with Fidelity’s Student Loan Calculator.) And he made sure that his extra payments were applied to his loan’s principal amount, which was key to reducing his total balance.

Following the money

Of course, it’s hard to make progress on debt without sufficient income. Although Oldham had planned to work for a Boston-area startup post-graduation, the company hit business problems in the spring of 2019, and called him shortly before graduation to tell him that he was still welcome to come to work, but he wouldn’t be getting paid.

So he went into business for himself, turning his full attention after graduating to his podcast-booking venture. He started finding a niche in real estate investing podcasts—taking on investors as clients, and landing them spots on podcasts about real estate investing—which let him build a name in the industry.

As his company gained traction, from late 2019 into early 2020, he was able to raise prices and start investing in marketing—paying for online ads and hiring a part-time assistant to send cold email pitches to prospective clients—which helped his business continue to build momentum.

And while the COVID-19 shutdown was scary for his company’s prospects, it meant there was little temptation to go out and spend, so it was easier to send any extra income straight to his loans. “Anytime I got a new client the money was either going to the business, going to taxes, going to living expenses, or going to loans,” he says. “I didn’t have any fun.”

Free and clear

By August 2020, Oldham had whittled his student loan balance down to just $5,000. “I realized if I had a good month in September, I could pay it off.”

He made his final loan payment on September 30, 2020, exactly one year after his first payment on his consolidated loan.

Of course, not everyone has the inspiration (or stomach) to start a business, or will feel comfortable going to such extremes of avoiding all discretionary spending. If you’re chipping away at your debt more gradually, consider whether following the avalanche or snowball approach might help you make faster progress. The avalanche approach entails making extra payments on your highest interest rate debt first, while the snowball method involves paying off your smallest balances first. (No matter what approach you choose, always make at least your minimum payments on all debts, to help protect your credit score.)

And even if it takes years to bring your goal of zero balances within reach, remember that all your hard work will eventually be rewarded. For Oldham, finally eliminating his student loans “felt as though a weight had been lifted off my shoulders.” After a year of near-total frugality, he went out to a nice restaurant, and ordered a steak.