Last Updated on January 16, 2023

How to Pay Off Student Loans Early

Paying off your student loans early can be a great way to save money. If you don’t want to be paying off student loan debt for the next 20 years, here are some ways to get started:

- Make extra payments each month

- Choose an income-driven repayment plan (IDR)

- Consider refinancing your loans with a lender that offers low interest rates

How To Pay Off Student Loans Early

9 ways to pay off your student loans fast

Some of the best strategies to pay off your student loans faster include:

- Make additional payments.

- Establish a college repayment fund.

- Start early with a part-time job in college.

- Stick to a budget.

- Consider refinancing.

- Apply for loan forgiveness.

- Lower your interest rate through discounts.

- Take advantage of tax deductions.

- Ask your employer about repayment assistance.

1. Make additional payments

If you can afford it, make larger payments to cut the principal more quickly and reduce the total payoff time. By reducing the principal balance, you’re minimizing the duration of the loan period and the interest accrued.

For example, a $25,000 student loan with 6.8 percent interest and a 10-year payback period would cost $288 a month. Using a student loan calculator, you can see that paying $700 a month instead of $288 enables the borrower to repay the loan in just over three years.

Another strategy is to add payments, sending in checks every two weeks rather than monthly.

“Just be sure to advise your loan servicer to apply your extra payment to your principal balance, rather than placing your account in a ‘paid ahead’ status,” says Jessica Ferastoaru, student loan counselor at Take Charge America. “This will allow you to pay down your principal balance more quickly and save money on interest.”

If you have multiple loans, there are several strategies for choosing which to send those extra payments to. To save the most money, it’s usually best to start with the loan with the highest interest rate.Key takeawayMaking larger payments will help you cut through the principal quicker, which will allow you to pay off your loan sooner.

2. Establish a college repayment fund

If you’re not sure how much more you can devote to your student loans every month, set up automatic transfers to a separate savings account specifically for college debt. Transferring money automatically into savings is effective because you won’t be able to spend it on something nonessential like clothes or dining out.

Just make sure to set up a separate account for paying back your college debt. Don’t use a checking or savings account you already have, because you might be tempted to use that money for something other than your student loans. Compare savings accounts and put your money in a high-yield savings account to maximize your returns.Key takeawaySetting up an account specifically for your student loan repayment funds can be a great way to compartmentalize your finances or control out-of-budget spending.

3. Start early with a part-time job in college

Getting a part-time job while attending college is one way to keep college debt in check, because you can use those earnings to get a head start on paying down your balance.

Let’s say you’re able to work a part-time job that allows you to put away $500 a month. In a year, that’s $6,000 you can put toward paying off your loans. What’s more, you can earn up to $7,040 a year without affecting your eligibility for need-based financial aid.

Check your school’s resources or career center to see if they’re hiring for any on-campus jobs. Typically, on-campus jobs tend to be more understanding of unusual or busy class schedules.Key takeawayIf you’re still able to properly manage your coursework, a part-time job is a great way to earn enough money for a student loan savings account while learning time-management skills.

4. Stick to a budget

Not knowing how to manage finances properly can prevent students from paying off their loans quickly. That can lead to delays in pursuing more fulfilling financial goals. By planning and understanding your monthly cash flow, you can make some necessary sacrifices and avoid falling off the budgetary wagon.

“If you’re trying to pay down your student loans faster, one of the best ways to reach your goal is to develop a budget,” says Ferastoaru. “If you’re able to meet a savings goal each month by sticking to a budget, you can use that money to pay down your student loans.”

Do an assessment of your spending habits and your ability to keep a budget. If you find it hard to maintain a solid budget as a college student, use a student budget calculator to help you get on track and stay there.Key takeawayYour financial health and spending habits can greatly impact your ability to pay off your student loans. Be diligent about sticking to a budget during your repayment period.

5. Consider refinancing

If you’re not sure how to pay off student loans quickly — or if it doesn’t seem feasible — you may be paying too much in interest.

In this case, you might want to consider refinancing your student loans for a lower interest rate, a shorter repayment period or both. While refinancing federal loans with a private lender will cause you to lose some federal benefits, it could also allow you to pay off your loans faster.

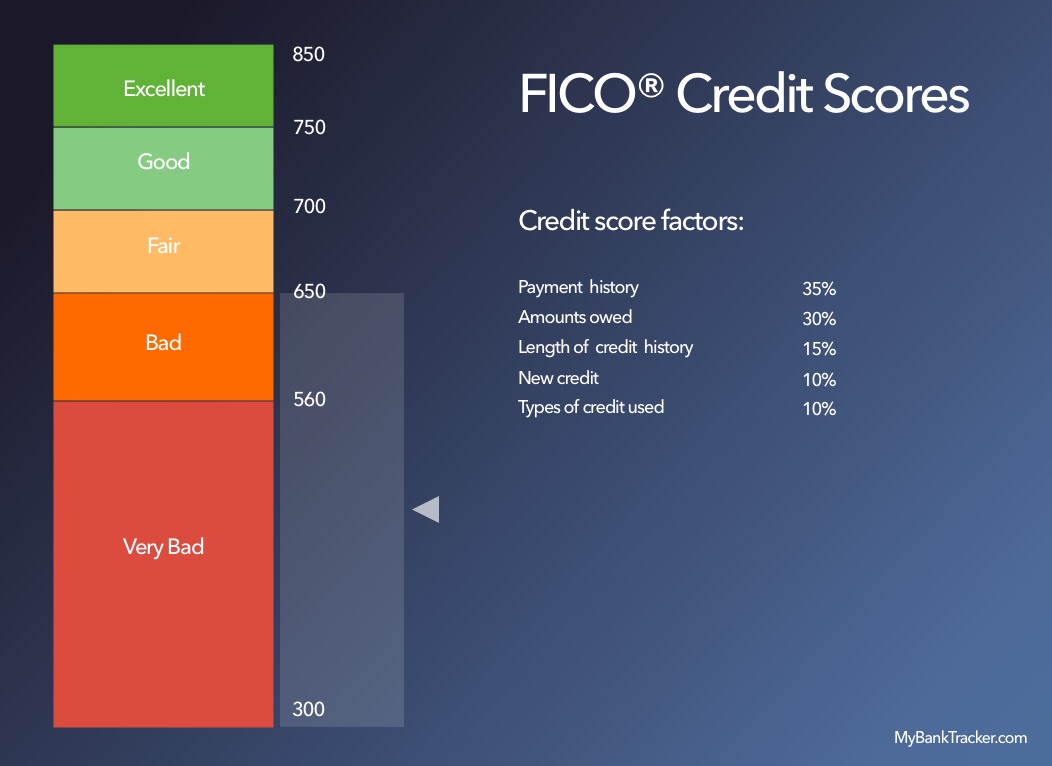

Timing is key with this strategy. Your credit score is typically going to be at its lowest immediately after graduation, which generally means that the interest rates you’re offered will be higher. Many lenders also require you to have stable income or employment history to qualify. This makes it doubly important to shop around with a few lenders in order to see which offers you the best rates.

You can refinance your loans more than once, which may be worthwhile if you drastically improve your credit score or increase your annual income.Key takeawayRefinancing may be a good option if you have private loans. While it’s not for everyone, refinancing can help you score a lower interest rate or different repayment terms.

6. Apply for loan forgiveness

Forgiveness programs can eliminate all or part of your student loan debt, but each program has unique requirements and strict approval standards.

The most well-known program is Public Service Loan Forgiveness (PSLF). To be eligible for this program, you must be employed full time in a public service position by a government or nonprofit organization and make 120 qualifying payments under an income-driven repayment plan. Getting approved for the program is difficult, so read through the details carefully to stay on track.

The Teacher Loan Forgiveness program is another option. To qualify, you must have an eligible loan under the Direct Loan Program or FFEL Program and teach full time for five consecutive years in a low-income school or educational service agency. At least one of those years must be after the 1997-98 academic year. The program forgives up to $5,000 or $17,500, depending on your specialty.

It’s also possible to have a portion of your student loans forgiven if you’re on an income-driven repayment plan. Once the 20- or 25-year repayment term ends with these programs, any remaining balance is forgiven. If you hit the end of your repayment period before 2026, the forgiven amount is not taxable.Key takeawayIf you’re willing to work in a specific occupation and adhere to a variety of other program requirements, it may be possible to get a substantial portion of your loans forgiven.

7. Lower your interest rate through discounts

Most lenders will offer a 0.25 percent to 0.5 percent discount if you set up automatic payments on your loan.

In addition, private lenders may offer other interest rate discounts if you meet certain criteria, like making a certain number of on-time payments or taking out another loan with the same company. If you have private student loans, contact your lender and ask about any opportunities for interest rate reductions or discounts.Key takeawayIt may be possible to reduce the interest rate on your existing loans by setting up autopay or asking about loyalty discounts.

8. Take advantage of tax deductions

The federal government offers a student loan interest deduction on your taxes for interest paid during the year on qualified loans. The law allows you to deduct up to $2,500, depending on your adjusted gross income. The deduction is available for both federal and private student loans.

You can claim this tax deduction if you’re legally required to pay interest on a qualified student loan and your filing status is not married filing separately. There are also adjusted gross income limits for this program, which are set annually. You do not need to itemize to claim this deduction.

Those who qualify for the deduction will generally save a few hundred dollars on their income taxes, which could help with student loan repayment. “If you pay less in taxes, this could free up some extra money to pay down your debt. It’s a good idea to speak with a tax advisor to make sure you’re taking advantage of any relevant tax benefits related to your education,” says Ferastoaru.Key takeawayThe student loan interest deduction allows you to deduct up to $2,500 in interest paid on federal and private student loans.

9. Ask your employer about repayment assistance

There are many employers that have begun offering student loan repayment assistance or tuition reimbursement. Some employers, including Starbucks and Walmart, even offer free college for workers who sign up for degree programs within a chosen network of courses and schools.

Employers can contribute up to $5,250 toward an employee’s college tuition or student loan repayment assistance through 2025 with favorable tax treatment. This benefit is not considered taxable income for the employee, which is a major boon for workers who are pursuing higher education while continuing to work.

Employers can deduct the expense on their end as well, paving the way toward a considerable tax benefit on both ends. Check your employee manual or speak with your HR department to see what kind of tuition assistance or loan repayment options are available at your company.

should i pay off my student loans in one lump sum

Should You Pay Off Your Student Loan in Lump Sum?

Learn about the benefits and drawbacks of making a lump sum payment toward your student loan debt. Find out how this strategy can affect your savings, investments, credit scores, and more. Use the pointers to decide if you should make this financial move.

Student loan debt can be a looming financial burden that many college graduates would prefer to have off their plate.

So, if you have the ability to pay a large part of it (or all of it) at once, you may want to consider the benefits and drawbacks of lump sum payments towards your college debt.

To be clear, you are in a very fortunate position to be able to get rid of a big chunk of your student loan debt. Before you make this financial move, here are some points to think about.

Benefits of Lump Sum Payments

There are many reasons to pay your student off with one lump sum — the benefits affect you financially and mentally.

Save on interest charges

One of the biggest is the interest savings. Student loans, especially private student loans, can have high interest rates. Some might even have variable interest rates, meaning your rate could increase at any time.

Picture this scenario:

You owe $45,000 in student loans. The interest rate on the loan is 5.8% and you are on a 10-year payment plan.

Each month, you’ll pay $495.08 towards the loan. After 10 years, you’ll have paid the loan off in full. You’ll have made 120 payments of $495,08, totaling $59,409.60. That’s almost $15,000 in interest over the life of the loan, more than $1,000 per year down the drain.

If you have the cash on hand to pay the loan in full or put a major dent in it, it can save you a lot of money in interest charges.

Shorter repayment period

If you are on a set payment plan and know when you’ll have your loan paid off by making the minimum payments, a lump sum payment can reduce how long it takes to pay the loan off.

If you get some extra cash, possibly as a gift or bonus from work, you can apply it towards your loan immediately. If you then continue to make your usual monthly payments, you’ll pay the loan off ahead of schedule.

Psychological benefits

Being in debt is a scary thing. If you have a lot of debt or bills to pay, it can feel like people are banging down your door to get your money. If you worry about money on a regular basis, being debt free can be a very freeing feeling. That can be reason alone to pay your student debt in a single lump sum.

Downsides of Lump Sum Payments

Despite the many benefits of paying your loan in a lump sum, there are reasons to avoid doing so.

Student loan interest tax deduction

Though you might pay a lot of interest on your student loan, there’s a tax benefit that reduces the pain of those interest payments.

You are allowed to deduct up to $2,500 in student loan interest from your income when filing your federal taxes. In effect, this benefit reduces your loan’s effective interest rate.

You’ll have to calculate whether that benefit lowers the rate of your loans enough that you don’t want to pay them immediately.

To be eligible for the deduction, your modified adjusted gross income (MAGI) must be below $80,000 ($160,000 for couples). If you make more than $65,000 ($130,000 for couples) you can claim a partial deduction.

Missing out on better returns

When dealing with finances, it’s important to look at your situation carefully to determine the best thing to do. Sometimes, the thing that feels like it makes the most sense is the wrong move to take.

Historically, the S&P 500 (the 500 largest companies in America) has averaged a 10% annualized return.

If you have the stomach to handle the market’s volatility, you can come out ahead by investing rather than making extra payments on your loans. Just don’t discount the value of a loan payment’s guaranteed return in reduced interest charges.

Temporary effect of credit

As counterintuitive as it is, paying your loan off could reduce your credit score. When you pay your loan off, the loan account will close. That will reduce the average age of your credit accounts. If you don’t have many credit cards, this can have a big impact on your credit score.

Always Fund Your Emergency Fund First

Even if you want to pay off your student loans in a lump sum, make sure to fund your emergency fund first, no matter what.

The reason for this is that you never know when a financial catastrophe can hit. You might lose your job, get injured, need your car repaired, or have something else expensive happen.

When it does occur, you want to be able to pay the bill without taking out a new loan.

If you use all your cash to pay off a student loan, hoping to save on interest, you’ll just wind up paying a higher rate when you use your credit card to finance an emergency.

Aim to keep at least 3-6 months of living expenses in an online savings account. That amount of money should be enough to help you handle any catastrophe or job loss and give you a cushion to get back on your feet.

Keeping the account at an online bank is a good choice because it makes the money harder to access on a daily basis. That leaves you with less temptation to spend it.

Also, online banks pay the best interest rates, so the opportunity cost of not investing the cash is as low as possible.

How Do You Pay off The Remainder of Your Debt?

If you’ve decided to pay off the remainder of your debt, there’s a process to make sure you actually pay the debt in full.

The first thing you should do is contact your lender to request a payoff amount.about:blank

This is the amount that you must pay to have the loan consider paid in full. This may differ from your current balance because of pending interest charges or other fees.

Usually, your lender will provide you with a payoff amount that is valid for a specific time period. Once you know how much you have to pay, send that exact amount to the lender by the deadline that they specify.

Once you make your final payment, don’t celebrate immediately. Wait for confirmation that your loan has been paid in full.

Your lender should send you a congratulatory letter saying that your loan is paid. If you don’t, contact the lender to request one.

Keep this letter on hand for a while, at the very least a few years. You can use the letter to prove that you are student-debt free. That can be helpful when applying for other loans like a car loan or mortgage.

Also, check your credit report. You should see the loan marked as paid on your report. It can take up to three months for the change to be reflected on your credit report, so be patient.

What Happens If You Leave a Small Balance?

If you attempt to pay your loan off but forget to ask for a payoff amount, it’s possible that you’ll leave a small balance on the loan. This balance could be smaller than a dollar, but it will still be there.

What happens from there depends on your lender. Some lenders will require that you pay the outstanding amount.

Make sure to get a payoff amount this time so that this scenario doesn’t happen again. Other lenders will simply forgive the balance, leaving you debt free.

If you accidentally leave a very small balance on a loan, there’s no harm in contacting the lender.

Ask if they’re willing to forgive the balance of a few cents. In the worst case, they’ll refuse and you can ask for a payoff amount and the best way to send your final payment.

In the best case, you’ll finish your phone call with one fewer debt to your name.

Conclusion

Paying off your student loan debt can be very freeing. If you have excess cash and can pay it off in a lump sum, it can be tempting to do so.

Whether it’s a good idea to actually do it will depend on your overall financial situation.