Last Updated on July 29, 2023

Student loans are the only financial aid that accrues interest while you’re in school.

It’s a common question: how do student loans accrue interest?

If you have a student loan, you’ve probably wondered at some point how your debt is growing even though you haven’t used it yet. The answer to this question is that student loans accrue interest while you’re still in college, or even before you start college if you’re planning on taking out federal loans.

In order to understand how student loans accrue interest, it’s important to know what type of loan you have. There are two main types of student loans: federal and private. Federal loans come from the government and include Perkins Loans and Stafford Loans, which are both subsidized by the government so that borrowers pay a fixed percentage of their income each month toward their loan balance; unsubsidized Stafford Loans, where borrowers don’t receive any financial assistance from the government but still pay just as much every month; PLUS Loans for parents of dependent students; and Nursing Student Loans. Private loans come from banks or other providers like Sallie Mae or LendKey (formerly Discover Student Loans).

How Do Student Loans Accrue Interest

To better understand how student loan interest works, let’s start by defining what “interest” means.

Interest on a loan of any kind – college, car, mortgage, etc. – is, essentially, what it costs to borrow money. It is calculated as a percentage of the principal (the amount you borrow), and this percentage is what’s known as your interest rate.

How does student loan interest work when paying back your loans?

Student loan interest rates can be fixed (unchanging for the life of the loan) or variable (fluctuating throughout the life of the loan). In both cases, the lower the interest rate, the less you’ll owe on top of the principal, which can make a big difference in the total amount you’ll owe on your loan over time. Federal loan interest rates remain fixed for the life of the loan. Private student loans vary by lender, but most lenders offer both variable and fixed interest rates.

A student loan is often a long-term commitment, so it’s important to review all of the terms of your promissory note (sometimes called a credit agreement) before signing. This note is just how it sounds – an agreement or promise you make to pay back your loan within the parameters laid out by your lender.

Terms in a credit agreement include:

- Amount borrowed

- Interest rate

- How interest accrues (daily vs. monthly)

- First payment due date

- Payment schedule (how many payments – or “installments” – it will take to pay back the loan in full)

Your student loan will not be considered repaid in full until you pay back both the principal and the interest. To better understand how these costs combine, let’s dive into some common questions about student loan interest.

Your interest rate is determined by your lender. In most cases, if you’re considered a riskier candidate (and many students are, simply because they lack credit histories and steady incomes), the loan can be more expensive by way of a higher interest rate. To help secure a lower interest rate, students often apply with a cosigner. It might be difficult, but it’s not impossible to get a private student loan without a cosigner.

This applies more to private student loans than federal student loans, which have a separate application process that does not always consider the credit worthiness of applicants.

How is interest calculated on federal student loans?

Federal student loans, which are issued by the government, have a fixed interest rate (unchanging for the life of the loan), which is determined at the start of the school year. The rate determination is set in law by Congress.

Federal student loans and simple daily interest

Federal student loans adhere to a simple daily interest formula, which calculates interest on the loan daily (as opposed to being compounded monthly).

Since federal student loans are issued annually (and they don’t calculate your yearly balance for you), it’s fairly simple to calculate the amount of interest you’ll owe that year. Just take your annual loan amount (the principal), multiply it by your fixed interest rate, then divide that amount by 365:

Principal x Interest Rate / 365

Example:$5000 x 5% / 365 = 0.68 (68 cents per day will accrue on this loan)

With these stabilized variables, interest on federal student loans can be easier to calculate and predict than interest on private student loans. However, since both types of loans might be required to cover costs, it’s a good idea to understand how interest works on both.

How is interest calculated on private student loans?

Private student loans, which are issued by banks, credit unions, and other non-government entities, can have either fixed or variable interest rates, which can fluctuate during the life of a loan.

Student loan interest rates can vary from lender to lender, to get a better understanding, let’s take a look at an example.

If your loan balance is $2,000 with a 5% interest rate, your daily interest is $2.80.

1. First we calculate the daily interest rate by dividing the annual student loan interest rate by the number of days in the year.

.05 / 365.25 = 0.00014, or 0.014%

2. Then we calculate the amount of interest a loan accrues per day by multiplying the remaining loan balance by the daily interest rate.

$20,000 x 0.00014 = $2.80

3. We find the monthly interest accrued by multiplying the daily interest amount by the number of days since the last payment.

$2.80 x 30 = $84

So, in the first month, you’ll owe about $84 ($2.80 x 30) in monthly interest. Until you start making payments, you’ll continue to accumulate about $84 in interest per month.

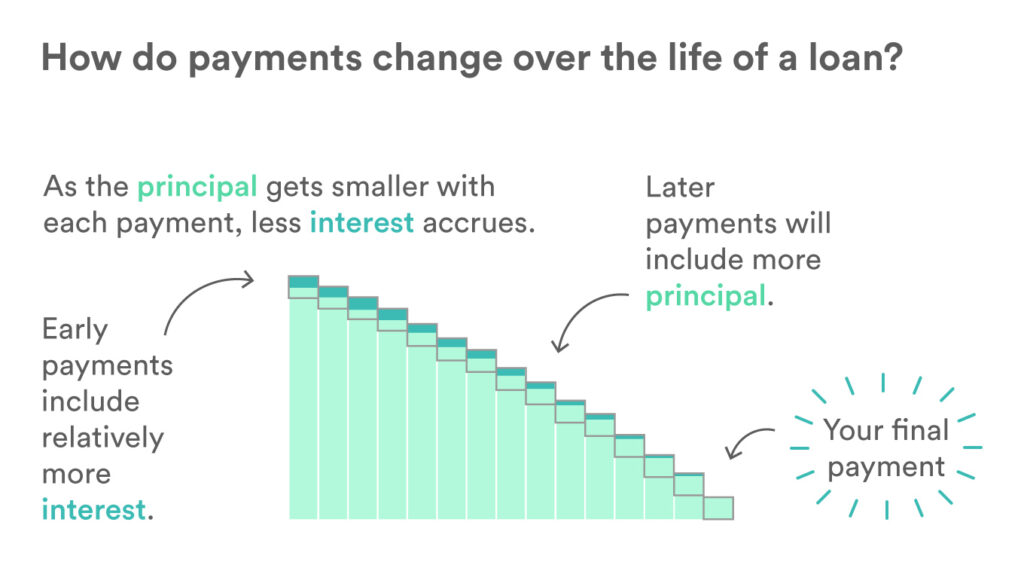

Be sure to keep in mind that as you pay off your principal loan balance, the amount of interest you’re paying each month will decrease.

student loan interest freeze

On April 6, the White House released a press briefing announcing the U.S. Department of Education was extending the forbearance on student loan repayment, interest and collections through Aug. 31, 2022.

President Biden said in extending the COVID-19 national emergency, he recognized that the U.S. was still recovering from the pandemic. And that while we are doing better than we were a year ago, we aren’t there yet. Recent Federal Reserve data suggests “millions of student loan borrowers would face significant economic hardship, and delinquencies and defaults could threaten Americans’ financial stability,” if loan payments resumed May 1, 2022.

Originally, an executive order from former President Trump had the Federal Student Aid office suspend monthly loan payments, collections on defaulted loans and reduce the interest rate to 0%, on March 13, 2020. Then the CARES Act made these provisions into law a week later and remain until Sept. 30, 2020. Since then the freeze has been extended numerous times.

Prepping for when student loan payments resume

Only time will tell. The Department of Education said it will reassess things and continue to do so until it is feasible for student loan borrowers to start paying back their loans.

Another key factor is when payments resume, those who previously had delinquencies or defaulted on their loans will have their slates wiped clean. The government is hoping that by doing this, borrowers will be in a better place to start paying their loans back because they won’t be restarting on a deficit.

In the press briefing, Biden said he wants borrowers to work with the Department of Education to make a plan for when payments resume. He gave looking into Public Service Loan Forgiveness as one option open to borrowers, and said he and Vice President Harris will continue to support borrowers in need and believe that this pause will be “a continued lifeline” as the U.S. recovers from the pandemic.