Last Updated on January 19, 2023

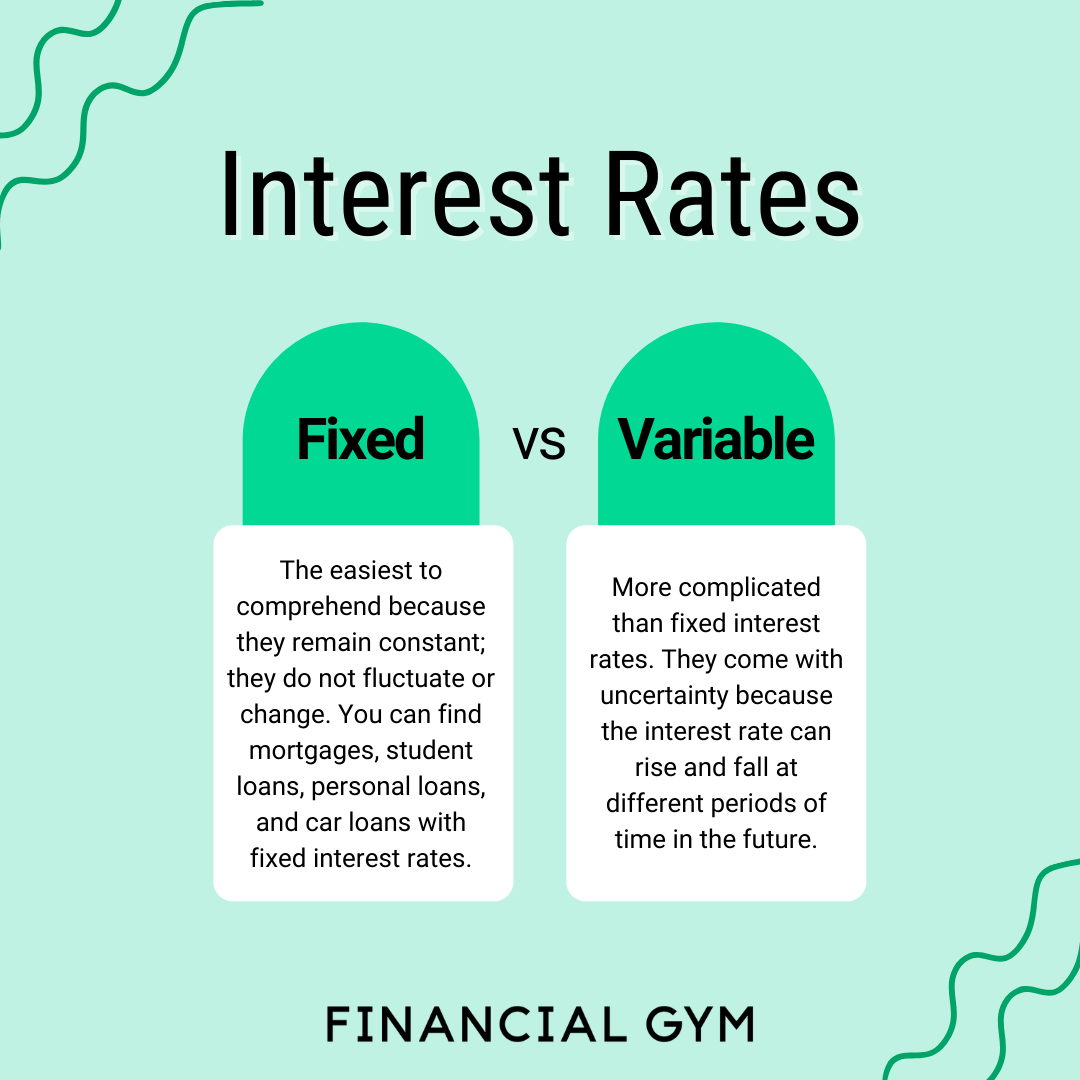

When you’re planning to go to college, it can be difficult to know if you should take out a fixed rate or variable rate student loan. Both have advantages and disadvantages, so it’s important to understand which one is right for you.

Fixed Rate Student Loans

A fixed rate student loan means that the rate of interest on your loan will not change over the life of the loan. This can be an advantage because there is no risk of the interest rate increasing unexpectedly. However, fixed rate loans tend to have higher interest rates than variable rate loans because lenders know they won’t have to compete with other lenders for borrowers’ business at lower rates of interest.

Variable Rate Student Loans

Variable rate student loans are those where the interest rate may change over time based on factors such as market conditions or changes in Federal Reserve policy. Variable rate loans tend to offer lower monthly payments than fixed rate loans but they also carry more risk because the borrower has no idea what kind of interest rate may apply until after they’ve taken out their loan.

Fixed Vs Variable Rate For Student Loans

The main difference between fixed and variable student loans is whether the interest rate can change. However, there are some other areas your rate can affect, including your budget, your student loan payment and how your payment relates to your future income.

| Fixed-rate student loans | Variable-rate student loans | |

|---|---|---|

| Benefits | Interest rate will never change Monthly payments are consistent Know exactly how much interest you’ll pay | Lower starting rates Benefit from market changes (in some cases) Lower monthly payments if interest rates are low |

| Drawbacks | Higher starting rates No benefit if interest rates drop | Rate can rise over time Monthly payment can change |

Fixed-rate student loans

Fixed rates remain constant for the duration of the loan term, which means that your monthly student loan payments will be predictable as you pay off your debt. The only way to change a fixed interest rate is by refinancing the loan.

While fixed rates are typically higher than the lowest advertised variable rates, they provide stability because the payment won’t change. When you begin the repayment phase for your student loans, you’ll know exactly how much you’ll pay every month and how much interest you’ll pay overall.

Variable-rate student loans

Variable interest rates are tied to market conditions, so your student loan payment could increase or decrease based on an adjustment in your interest rate. Lenders typically tie the loan’s variable rate to a benchmark rate, like the prime rate or the Libor index.

While you might start off with a lower payment than you would with a fixed-rate loan, there’s a chance that your interest rate — and monthly payment — could rise later on.

is student loan interest fixed

A fixed-rate student loan offers a predictable monthly payment, with an interest rate that doesn’t change over the life of the loan. A variable-rate student loan, on the other hand, has an interest rate that can fluctuate, increasing or decreasing compared with a similar fixed-rate loan, depending on market conditions. Generally, fixed-rate student loans are a safer choice.

Your student loan’s interest rate affects your monthly payment and how much interest you pay overall. Both fixed and variable interest rates have benefits and drawbacks. Weigh the two options carefully because the choice you make can have a serious effect on your short- and long-term financial future.

A fixed interest rate is somewhat self-explanatory: The rate remains constant for the duration of the loan. It will only change if you refinance or consolidate your loan.