Last Updated on December 15, 2022

Are you a doctor? Are you looking for student loans? We’ve got what you need.

If you are a student, who is studying medicine, then it is important to understand how to go about getting the best medical student loans. It can be confusing to find out how much you need as well as how much you can borrow in student loans. If you are unsure of how much money will be available for medical school, then here are a few things that you should know:

Medical school is expensive, but there are many ways in which you can make it more affordable for yourself. One way would be to get an extra part-time job while attending classes so that you have some extra money to pay off your student loans later on down the road once they come due after graduation day comes around!

The first step towards getting approved for any type of financial aid program is filling out all the necessary paperwork required by colleges and universities across America today! Some institutions require students complete applications before they even begin taking classes; whereas others may ask students fill out forms only after enrolling at least one semester prior (typically during spring time).

Report Highlights. The average medical school debt is $215,900, excluding premedical undergraduate and other educational debt.

- The average medical school graduate owes $241,600 in total student loan debt.

- 76-89% of medical school graduates have educational debt.

- 43% of indebted medical school graduates have premedical educational debt.

- The average medical school graduate owes 6 times as much as the average college graduate.

- 55% of medical school students use loans specifically to help pay for medical school (as opposed to undergraduate or premed debt).

Medical School Debt Statistics

Between medical school and undergraduate study, physicians must pay for 8 years of postsecondary education before they can work as doctors.

- Medical school graduates owe a median average of $200,000 to $250,000 in total educational debt, premedical debt included.

- Indebted medical school graduates who received more than $100,000 in scholarships owe a median average $115,000 if they attended a public institution and $130,000 if they attended a private medical school.

- $4.349 billion is the total educational debt among medical school graduates each year.

- An average medical school graduate owes more than 6 times as much in educational debt as an average college graduate.

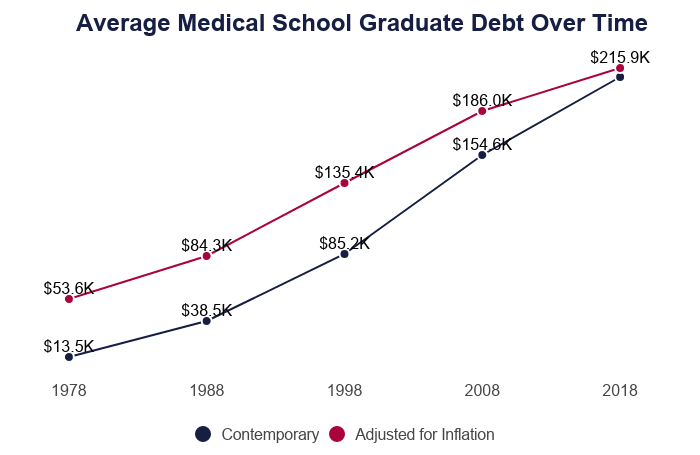

- A 177.7% increase in the average debt took just over 15 years.

- Adjusted for inflation, the cost of medical school has nearly doubled, increasing by 94%.

- 11.1% was the annual growth rate of medical school debt.

- 2.4% was the annual growth rate of the cost of medical school.

- In Canada, the average medical school debt among graduates is US$19,250.

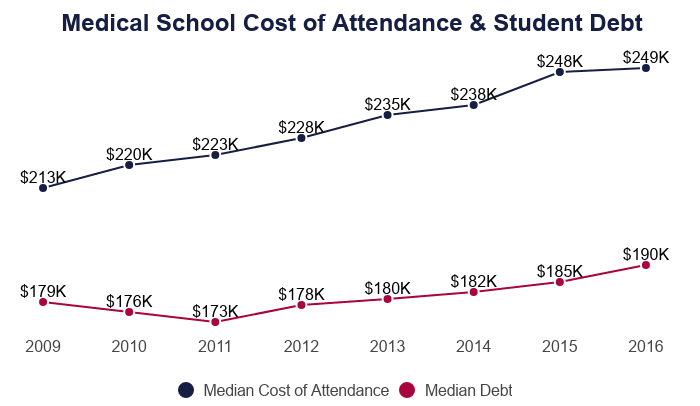

- If debt continues to outpace the cost of attendance at the present rate, the average medical student debt will exceed $300,000 by 2024.

Historical Medical School Debt

The average medical graduate’s debt rate outpaces the inflation of academic costs, which in turn outpaces economic inflation.

- In 1978, the average medical school debt in the U.S. was $13,500.

- That’s $53,648 when adjusted for inflation.

- Medical school graduates in the 1999-2000 academic year owed $87,000 in educational debt.

- Adjusted for inflation, the average debt for a medical school graduate was $124,700.

- Graduates owed an average of $78,700 for medical school alone in 2000.

- That’s $118,416 when adjusted for inflation.

- $223,100 was the average medical school debt owed by 2016 graduates.

- In 2010, 86% of medical school students graduated in debt.

- By 2017, 76% of medical students graduated with debt.

- Between 2010 and 2017, the rate of debtorship decreased by 11.6%.

- Medical school debt alone accounted for 55.8% of total educational debt among the Class of 2000.

- Medical school debt was 53.9% of 2016 graduates’ total educational debt.

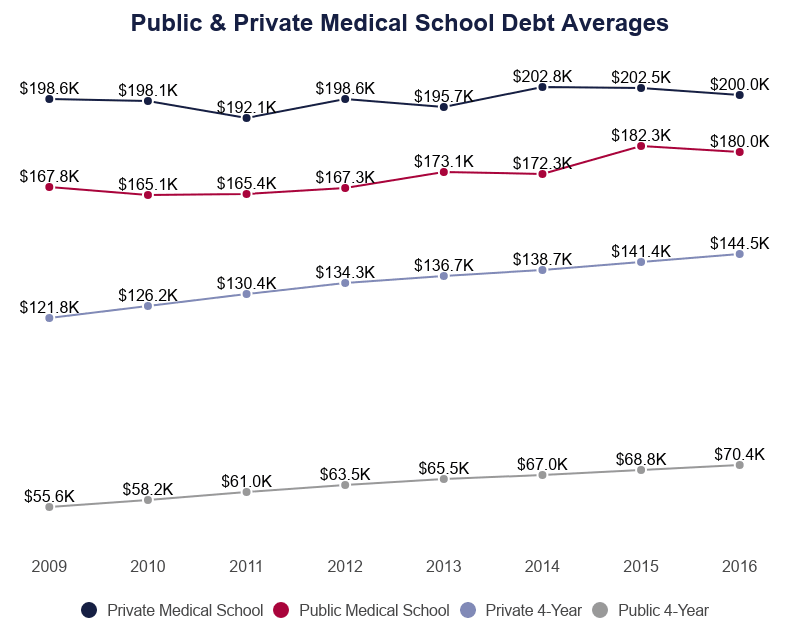

Public vs. Private Medical School Debt

The cost of attendance for a private medical school is higher than that of a public medical school. The rate of the debt increase, however, is not equal to the increased cost of attendance.

- Public medical school graduates owe $2000 less on average than private medical school graduates.

- $200,000 was the median student debt among private medical school graduates in 2016; the cost of their education was $306,200.

- $180,000 was the median student debt among public medical school graduates; $232,800 was the cost of their education.

- Private medical school graduates leave school owing 65.3% of their cost of attendance.

- Public medical school graduates leave school owing 77.3% of their cost of attendance.

- In 2009, private medical school graduates owed 73.8% of their cost of attendance.

- Also in 2009, public medical school graduates owed 89.7% of their cost of attendance.

Loan and Repayment Statistics

Some institutions have responded to the student debt crisis with more scholarships and loan forgiveness programs. Not everyone benefits from these programs, however, leaving some students to face increasing debt even as they continue to make payments.

- The average physician ultimately pays $365,000 – $440,000 for an educational loan plus interest.

- $165,000 – $240,000 is just from interest.

- A $200,000 debt can double in 10 years at current interest rates, even with regular payments.

- An average of 33% of indebted medical school students owe repayments on Perkins or disadvantaged student loan programs.

- 4.3% is the interest rate on the average federal direct unsubsidized loan for graduate or professional borrowers.

- $2,480 is the minimum monthly payment the average medical school graduate must make in order to pay off all educational debts within 10 years.

- Including interest, $291,681 is the graduate’s grand total pay-off.

- If the average physician can’t pay off educational debts within 10 years, their total educational costs will likely exceed $300,000.

- The medical school loans alone require 120 monthly payments of $1,951.

- That’s a total of $234,104 over 10 years.

- In the late 1980s, 59.9% of indebted medical school graduates had Health Professions Student Loans.

- By 2000, just 4.4% of indebted students had HPS loans; reports indicate little-to-no funds are being allocated to the HPSL program.

Medical School Debt & Socioeconomics

Students who come from families with a good deal of wealth accrued are more likely to attend medical school than those without. Low-income students are attending medical school at decreasing rates, possibly due to the specter of debt.

- 45.2% of medical school students cite their ability to pay off debt as a primary concern.

- 0.74% of indebted medical school graduates are born in rural areas.

- Low-income attendees declined by 34% in medical schools in Ontario, Canada.

- Since 1997, fees at these schools have increased 116%.

- In the United States, 50% of low-income graduates have medical school loan debt that exceeds $100,000.

- Among those with debts that exceed $200,000, those with Perkins or disadvantaged student loans are the majority.

- Students with loans that are not based on their parents’ income consistently owe the least on average.

- Students with nonincome-based loans are 30% less likely than low-income students to owe more than $100,000.

- 67.8% of indebted low-income students graduated from a public medical school.

- They are 35% less likely to owe more than $200,000.

- Among students entering medical school, 17% had debts unrelated to their education.

- Among those, 58.2% had less than $10,000 in debt unrelated to their education.

- 11.2% had noneducational debts exceeding $100,000.

| Demographic | Share with Student Debt | Median Student Debt |

|---|---|---|

| American Indian and Alaska Native | 80% | $212,375 |

| Asian, not Hispanic | 61% | $180,000 |

| Black, not Hispanic | 91% | $230,000 |

| Hispanic | $75% | $200,000 |

| White, not Hispanic | 71% | 200,000 |

Medical School Debt Demographics

Financial struggles affect demographics to varying degrees. Sociologists, economists, and behavioral scientists agree that the root causes of financial disparities are social or socioeconomic factors.

- Male medical school graduates are 34.2% more likely than female graduates to leave school in debt.

- 60.2% of indebted medical school graduates are male.

- 33.4% are married.

- Among U.S. citizens, Black and African American medical school students owe more, on average, than their peers of any other race or ethnicity.

- 50% of Black medical school graduates are more than $200,000 in debt.

- 17.1% have debts of $300,000 or more.

- Asian students attending public medical schools have the second-lowest average debt balance.

- Students of unknown or unspecified race attending public schools graduated with the least amount of debt.

- Non-citizens and residents who graduated from public medical schools have the greatest amount of average debt.

- Black or African American graduates who attended private medical schools have the second-highest amount of debt.

Medical School Tuition and Fees

Just applying to medical school costs thousands in entrance exam fees, preparation courses, travel & interview expenses, transcript processing fees, etc. The price of medical school has increased at more than twice the rate of currency inflation; this has been a significant contributing factor to the rise in medical school graduate debt.

- $58,500 is the average cost of tuition and fees for a first-year medical student in 2020.

- $16,900 was the total cost of tuition and fees for the average first-year medical student in 2000.

- Adjusted for inflation, that’s $25,500.

- The cost of medical school increased 129% in 20 years, even after adjusting for inflation.

- During that time, the cumulative rate of inflation of the U.S. dollar was 50.5%.

- $2,800 is the average cost of medical school application fees alone.

- $10,000 is the application budget recommended by academic counselors.

- 55% of medical school students use loans to help pay for school.

- In the U.S., 131 institutions award over 18,000 medical degrees each year.

- 53,371 unique applicants submitted a total of 897,000 applications to medical schools for the 2019-2020 academic year.

- 21,869 applicants were accepted.

- 39.4% of those accepted were from out-of-state.

Federal student loan forgiveness programs

If you took out federal student loans to pay for medical school, you may qualify for loan forgiveness programs in some cases. These programs allow you to have some or all of your student loan debt forgiven, rather than needing to repay the entire debt to the lender.

Public Service Loan Forgiveness

The U.S. Department of Education offers the Public Service Loan Forgiveness program, or PSLF, to eligible borrowers with Direct Loans. You may be eligible for forgiveness if you’re employed full-time by a government entity (federal, state, local, or tribal) or not-for-profit organization. This includes military service members.

In order to qualify for the PSLF program, you’ll need to have federal Direct Loans or consolidate your existing federal loan debt into a Direct Consolidation Loan. You’ll also need to be paying off that debt under an income-driven repayment (IDR) plan.

In addition, you must make 120 qualifying payments while working for a qualifying employer before any remaining balance is forgiven. Once you’ve made 120 qualifying payments, you can request that your remaining debt be transferred to a PSLF servicer and, hopefully, forgiven.

It’s important to note that in order to be eligible (even if you meet all other requirements), you’ll need to be employed full-time by an eligible employer both when you submit the forgiveness request form and when the remaining balance is forgiven.

Unlike some other loan forgiveness options, any remaining debt forgiven by the PSLF program won’t be considered income by the IRS. This means that the forgiven amount isn’t taxable.

Income-driven repayment plan forgiveness

To prevent your federal student loan payments from eating up too much of your monthly discretionary income, the Department of Education offers four income-driven repayment plans: Income-Based Repayment (IBR), Income-Contingent Repayment (ICR), Pay As You Earn (PAYE), and Revised Pay As You Earn (REPAYE).

If you qualify, you may be able to reduce your monthly payments to 10% to 20% of your discretionary income. Your monthly payment obligation depends on both your income and family size.

IDR repayment plans last for 20 to 25 years, depending on which plan you enroll in. After the plan repayment period ends, any remaining federal student loan debt will be forgiven.

All federal student borrowers are eligible for the REPAYE Plan. The IBR, ICR, and PAYE plans are only available to those with certain types of federal loans.

National student loan forgiveness programs for doctors

If you have private student loans or don’t qualify for federal student loan forgiveness, other options are available exclusively to those in the medical fields. These programs may allow you to get a portion of your student loan debt forgiven, simply for doing the job.

National Health Service Corps Loan Repayment

The NHSC Loan Repayment Program offers up to $50,000 in nontaxable student loan repayment in exchange for a two-year, full-time service commitment and up to $25,000 in student loan repayment for two-year, half-time service.

The NHSC offers forgiveness to eligible borrowers working at an NHSC-approved site who meet the following requirements:

- U.S. citizen or national

- You provide care in the Medicaid, Medicare, or state CHIP programs (or eligible to participate)

- Fully trained and eligible to work in the primary care medical, dental, or mental and behavioral health fields in your state

Applicants need to have eligible student loan debt resulting from education expenses required for their health profession. Applications are accepted on an annual basis; for more information, visit the NHSC Loan Repayment Program page.

National Health Service Corps Substance Use Disorder Workforce Loan Repayment

The NHSC Substance Use Disorder Workforce Loan Repayment Program, also known as SUD Workforce LRP, is designed to support healthcare providers helping combat the opioid crisis in the U.S. It offers up to $75,000 in loan repayment funds for three years of full-time service, and up to $37,500 for three years of half-time service.

In order to be eligible for this award, you must work at a SUD treatment facility classified in a health professional shortage area (HPSA), with a score that would normally be too low to qualify for funding. You must also meet the same eligibility requirements as the loan repayment program above.

To learn more, visit the NHSC SUD Workforce LRP page.

National Health Service Corps Students to Service Loan Repayment

With the NHSC Students to Service Loan Repayment Program, eligible applicants may receive up to $120,000 in loan repayment assistance (up to $30,000 per year for four years). It’s available to students in their last year of medical school, nursing school, or dental school in exchange for three years of full-time service or six years of part-time service at an NHSC-approved site.

This award is only offered to U.S. citizens or nationals who are enrolled full-time in their last year of medical, dental, or nursing school. They’ll need to be pursuing an M.D., D.O., D.D.S., D.M.D., N.P., C.N.M., or P.A. degree at an accredited school, and must be eligible for federal employment.

To learn more, visit the NHSC Students to Service page.

National Institutes of Health Loan Repayment

The National Institutes of Health (NIH) Loan Repayment Program can help eligible borrowers pay off up to $100,000 of their student loan debt in exchange for a two-year research commitment.

Loan repayment options from NIH are available to current employees as well as applicants who aren’t employed by NIH. Eligibility is limited to U.S. citizens, nationals, or permanent residents with an eligible doctorate-level degree. If selected, borrowers must also agree to perform two years of research service for 20 or more hours per week.

To learn more or apply, visit the NIH website.

National Institute on Minority Health and Health Disparities Loan Repayment

The National Institute on Minority Health and Health Disparities offers a loan repayment award of up to $50,000 per year to eligible health professionals. At least 50% of the awardees must be from minority populations.

To qualify, you must have student loan debt equal to 20% or more of your base salary and agree to perform at least two years of clinical research. You must also be a U.S. citizen or national and have a qualifying doctorate-level degree.

To learn more or apply, visit the NIMHHD website.

Indian Health Service Loan Repayment

With the Indian Health Service (IHS) Loan Repayment Program, eligible clinicians can receive up to $40,000 toward their educational debt in exchange for a two-year commitment to serving American Indian and Alaska Native communities. With this program, your contract can also be extended annually until all your student loan debt is satisfied.

To learn more or apply, visit the IHS website.

State-specific student loan forgiveness programs

If you don’t qualify for federal or national loan forgiveness programs, you may be able to find state-specific programs. You can do an internet search to see what loan repayment programs might be available in your specific state. Here are two examples:

Georgia Physician Loan Repayment

The Georgia Physician Loan Repayment Program is one of several programs offered by the Georgia Board of Health Care Workforce. This program offers $25,000 each year for an initial two-year contract to physicians practicing family medicine, internal medicine, pediatrics, OB/GYN, geriatrics, or psychiatry. To qualify, physicians must practice in a health professional shortage area in a rural Georgia community.

To learn more about physician loan repayment programs in Georgia or to apply, visit the Georgia Board of Health Care Workforce website.

Maryland Loan Assistance Repayment for Physicians

In exchange for a two-year service commitment to a health professional shortage area or medically underserved area, Maryland-licensed physicians may receive up to $50,000 per year toward their student loan debt. This program is available to physicians, physician assistants, and medical residents within their last year of residency.

To learn more or apply, visit the Maryland Higher Education Commission website.

U.S. military repayment programs for medical loans

Many education benefits are available to U.S. military members, including repayment programs for those choosing a career in medicine who wind up with student loan debt.

Air Force Health Professions Loan Repayment

The Air Force Health Professions Loan Repayment Program offers $40,000 per year for up to two years (for a total of $80,000) in exchange for a two-year, active-duty commitment. It’s available to service members in various health professions, and can be used toward loan payments, interest, and other education or living expenses.

Keep in mind that about 25% in federal income taxes will be taken out of the loan repayment funds before they’re disbursed.

To learn more, visit the Air Force Institute of Technology website.

Army Health Professions Student Loan Repayment

The Army Health Professions Student Loan Repayment Program is available to active-duty or reserve Army service members who work as a doctor, dentist, or other healthcare professional. If you qualify, you can receive up to $40,000 per year for as many as three years — for a total of $120,000 — toward your medical student loan debt.

National Guard Health Care Professional Loan Repayment

In exchange for a seven-year commitment to the National Guard, you can receive up to $250,000 toward your medical education debt. This is broken down as $40,000 per year for the first six years and $10,000 for the seventh year (with a lifetime cap of $250,000).

This program is offered to healthcare providers in the Medical and Dental Corps, but may also include physician assistants, social workers, and veterinarians, depending on the year.

To learn more, visit the National Guard website.

Navy Health Professions Loan Repayment

The Navy Health Professions Loan Repayment Program is available to new recruits, as well as existing, active-duty Navy service members. It offers up to $40,000 per year toward student loan debt (minus 25% for federal taxes, taken prior to disbursement).

To be eligible, you must be fully qualified, in your last year of residency, or enrolled full-time in your last year of study and working toward a medical, dental, or osteopathic degree. You must also be qualified for (or already hold) an appointment as a commissioned officer.

To learn more, visit the Navy Medicine website.

Consider refinancing your medical school loans

If you’ve considered all other options for repaying or forgiving your medical school debt, but you don’t qualify or don’t have federal loans, you have another option: refinancing.

Refinancing your student loan debt, regardless of the balance owed, can simplify the repayment process and potentially save you money along the way. This process involves taking out a new private loan, which you’ll then use to pay off one or more existing lenders. You’ll make payments on the new loan moving forward.

With a refinance loan, you can:

- Combine multiple accounts into one, with just one monthly payment to manage.

- Lower your interest rate, saving money over the life of the loan.

- Reduce your monthly payment.

- Shorten your loan repayment term.

- Remove the debt obligation of a joint borrower, such as a parent who cosigned your loans.

It’s important to note that refinancing federal student loans into a private loan will mean giving up certain benefits, including income-driven repayment plans, student loan forgiveness programs, and forbearance or deferment. If you ever expect to be eligible for these programs or need those federal benefits, you may want to hold off on refinancing your federal loans.

If you’re ready to refinance your medical loans, Credible lets you easily compare student loan refinance rates in minutes.