Last Updated on January 19, 2023

Student loans are one of the biggest and most common forms of debt that many people carry. Fortunately, they are also fairly easy to get rid of! If you’ve got student loans, they will likely be a part of your debt-to-income ratio. But in some cases, your student loan debt may not even count toward your DTI at all!

Are Student Loans Considered In Debt To Income Ratio

Understanding Debt-to-Income Ratio (DTI) and Student Loans

What is debt-to-income ratio? It’s a ratio that affects your ability to access a loan. The basic idea is if you have too much debt relative to your income, lenders might hesitate or refuse to give you the credit you need for a large purchase. Your debt-to-income ratio (DTI) most often comes up when buying a house, but it is also considered by potential landlords or lessors of cars. By pulling your credit report, someone can calculate your DTI and decide whether to loan, rent, or lease to you.

How do student loans factor in? Obviously, student loans are a form of debt. Like other loans, your student debt shows up on your credit report. A potential lender or landlord will see your loan and factor it into your DTI ratio. But student loans will affect your DTI differently depending on the situation. I am going to outline what specifically goes into a DTI ratio and how student loans factor into several scenarios.

How To Calculate A DTI Ratio?

Your debt-to-income ratio is calculated by comparing your monthly debt obligations with your monthly income. Let’s take a close look at both.

Your debt obligations consist of recurring debt, which is debt you cannot cancel at any time. This includes mortgage, rent, car loans, personal loans, monthly minimum credit card payments, alimony, child support, and, of course, student loans. These are debts that are not going to go away until you’ve fully repaid them.

What does not count? Despite the fact that you may have contracts with your internet, cable, or phone provider, you can technically pull the plug on these services any time, so they do not count. Nor do other kinds of utilities like electricity and water. Even your health insurance does not count in your DTI. Of course, the money you’re paying back to your cousin who lent you a few hundred bucks last month is not an official debt, so cross that off the list, too.

In the case of housing, if you are selling a home before purchasing a new one, or if you are leaving your current rental and moving into a new one, your monthly obligations to your previous home will not count. Rather, a lender or landlord will be looking at the monthly mortgage or rent payment of the new place and calculate how much of your income that will take up. They aren’t going to lend or rent to you if they think too much of your income will be eaten up by housing costs, even if you technically have the income to cover it. However, if you’re not moving or if you’re keeping your old home, your current mortgage or rental will be incorporated into your DTI.

Your income can include not just wages, salary, and tips, but also alimony and child support, Social Security benefits, and pension. Pretty much any money you take in on a monthly basis on the books can be considered income.

How do you calculate your DTI number? Add up all your debts and all your income. Simply take your debt number and divide it by your income number. Example: If you have $1,000 per month in debt obligations and $3,200 per month in income, divide 1,000 by 3,200 and your answer is .3125. Round that to .31, multiply by 100, and you have a 31% DTI ratio.

The Effect Of Student Loans On Debt To Income Ratio

Student loans can be tricky when calculating DTI. The reason is millions of borrowers have federal student loans, and federal loans offer a lot of different repayment options, like income-driven repayment plans or a graduated repayment plan. Private loans, because repayment options are far fewer, are pretty straightforward. I’m going to go through the most common situations where DTI is an important factor and discuss how student loans affect each situation.

Getting A Mortgage

Buying a home is probably the biggest purchase you will make in your life. Your experience obtaining a mortgage to finance said home depends on your own personal finances, including your DTI, as well as the rules of the lender you are dealing with. Many lenders sell the mortgages they issue (including our favorite online mortgage lenders) — your debt, that is — and the two biggest purchasers of mortgages are Federal National Mortgage Association (aka Fannie Mae) and the Federal Home Loan Mortgage Corporation (aka Freddie Mac). Fannie and Freddie issue guidelines to lenders to maintain quality of the loans they buy and insure. These include guidelines about DTI and student loans for getting a mortgage. The two companies work similarly, though they have different rules that guide each organization.

Both Fannie and Freddie have issued new guidelines in 2017 regarding student loans and lending practices. These may affect your ability to get a mortgage, or they may even be the deciding factor. However, each lender is different and their adherence to guidelines may fluctuate.

Student Loan 101: What is a Debt-to-Income Ratio?

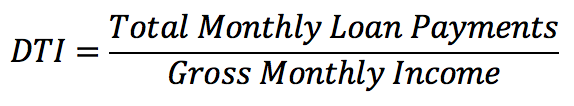

A debt-to-income ratio is the percentage of gross monthly income that is used to repay debt, such as student loans, credit cards, auto loans and home mortgages.

The debt-to-income ratio (DTI) is a measure of the borrower’s financial health.

A low debt-to-income ratio indicates that you can afford to repay their loans without experiencing severe financial stress. A high debt-to-income ratio may mean that you are over-extended and do not have sufficient income to repay your loans.

Two Types of Debt-to-Income Ratios

There are actually two different types of debt-to-income ratios.

Strictly speaking, the term “debt-to-income ratio” is supposed to mean the ratio of total debt to annual income. But, the debt-to-income ratio has come to defined as a payment ratio, which is the ratio of monthly loan payments to gross monthly income. It is also known as a debt-service-to-income ratio.

For example, the rule of thumb that total student loan debt at graduation should be less than your annual income is the equivalent of a traditional debt-to-income ratio less than 100%. Depending on the interest rate and repayment term, this is the equivalent of a payment ratio of 10% to 15%.

In this article, the term “debt-to-income ratio” refers to a payment ratio.

Do not confuse the debt-to-income ratio with your credit utilization ratio, which is sometimes called a debt-to-limit ratio. The credit utilization ratio is the percentage of available credit that is currently in use. It is the ratio of outstanding debt to the credit limits. The credit utilization ratio is used with revolving debt, such as credit cards, to determine if you are maxing out your credit cards. Lenders like to see a credit utilization ratio that is 6% or less.

The U.S. Department of Education’s gainful employment rules were based on two different types of debt-to-income ratios. One was a payment ratio that compared monthly loan payments to monthly income. The other compared monthly loan payments to discretionary income.

How Do Lenders Use the Debt-to-Income Ratio?

Lenders prefer borrowers who have a low debt-to-income ratio. A lower debt-to-income ratio increases the amount you can afford to borrow. Reducing your debt-to-income ratio can increase your eligibility for a private student loan.

The debt-to-income ratio is unrelated to your credit scores. Your credit history does not include your income, so your debt-to-income ratio does not appear in your credit reports. Rather, lenders calculate your debt-to-income ratio themselves using the information on your loan application and your credit history. They combine the debt-to-income ratio with credit scores, minimum income thresholds and other factors to determine your eligibility for a loan.

What is a Good Debt-to-Income Ratio?

A low debt-to-income ratio is better, when seeking a new loan, because it means you can afford to repay more debt than someone with a high debt-to-income ratio.

For student loans, it is best to have a student loan debt-to-income ratio that is under 10%, with a stretch limit of 15% if you do not have many other types of loans. Your total student loan debt should be less than your annual income.

When refinancing student loans, most lenders will not approve a private student loan if your debt-to-income ratio for all debt payments is more than 50%.

Keep in mind that refinancing federal loans means a loss in many benefits – income-driven repayment plans, any federal loan forgiveness opportunities, generous deferment options, and more.

When borrowing a mortgage, most mortgage lenders consider two debt-to-income ratios, one for mortgage debt payments and one for all recurring debt payments, expressed as a percentage of gross monthly income. The recurring debt payments include credit card payments, auto loans and student loans, in addition to mortgage payments.

Typically, the limits are 28% for mortgage debt and 36% for all debt. The maximum debt-to-income ratios are 31% and 43%, respectively, for FHA mortgages, and 45% and 49% for Fannie Mae and Freddie Mac.

So, borrowing or cosigning a student loan can affect your ability to get a mortgage.

How to Calculate

To calculate your debt-to-income ratio, follow these steps.

- Calculate your total monthly loan payments by adding them together. Look on your credit reports for your monthly loan payments.

- Divide the total monthly loan payments by your gross monthly income. Calculate your gross monthly income by dividing your annual salary by 12.

- Express the resulting ratio as a percentage.

This is the formula for calculating your debt-to-income ratio.

For example, suppose you owe $30,000 in student loan debt with a 5% interest rate and a 10-year repayment term. Your monthly student loan payment will be $318.20. If your annual income is $48,000, your gross monthly income will be $4,000. Then, your debt-to-income ratio is $318.20 / $4,000 = 7.96%, or about 8%.

If you switch to a 20-year repayment term, your monthly student loan payment will drop to $197.99. This will cause your debt-to-income ratio to drop to 4.95%, or about 5%.

How to Reduce Your Debt-to-Income Ratio

Fundamentally, reducing your debt-to-income ratio involves reducing your loan payments and increasing your income.

With student loans, you can reduce your monthly loan payment by choosing a repayment plan with a longer repayment term, such as extended repayment or income-driven repayment.

Other options include aggressively paying down your debt, qualifying for student loan forgiveness and refinancing to get a lower interest rate and a lower monthly loan payment.

Do not cosign loans, because a cosigned loan counts as though it were your loan on your credit reports.

Cut your spending and pay for purchases with cash instead of credit. Do not carry a balance on your credit cards. Do not get more credit cards. Delay any large purchases that may affect your debt-to-income ratio, such as buying a new car.